Breathtaking Tips About How To Sell Tax Credits

![Infographic] The Low Income Housing Tax Credit Program: How Does It Work? | Wilson Center](https://www.mossadams.com/getmedia/a7acfca6-d9f1-41e5-a18b-da630d3ee99a/21-TCI-0554_Federal_Tax_Credits-CHT2.png?width=945&height=1265&ext=.png)

Who can sell tax credits?

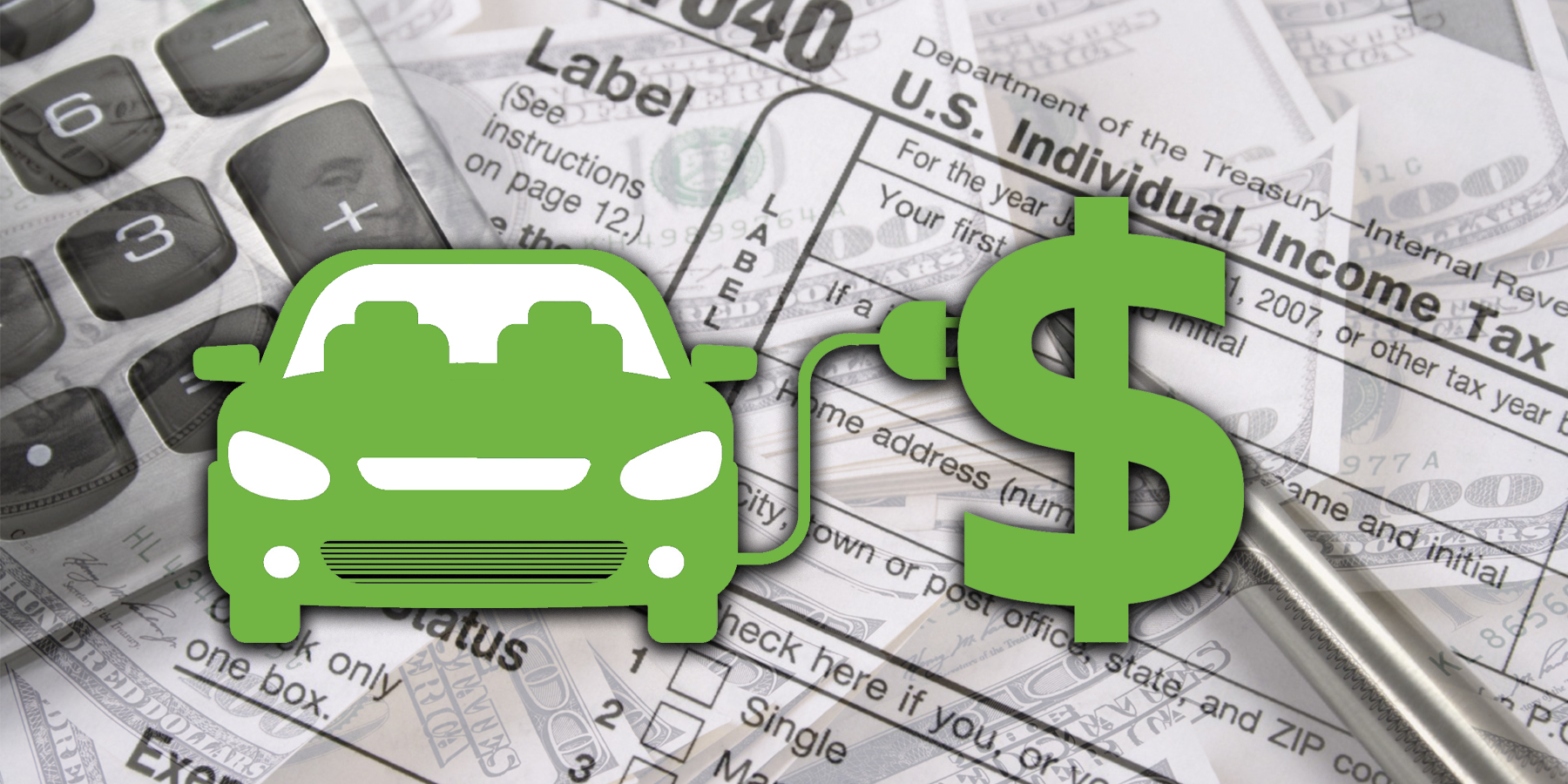

How to sell tax credits. Be a tech or biotech company; With the recent passing of the inflation reduction act, investors and developers have even more opportunities to monetize federal tax credits for both businesses. Sell their credits for at least 80% on their value;

Qualifying companies selling electricity, natural gas, or manufactured gas to an aluminum smelter may receive a b&o or public utility tax credit provided the selling price is reduced by the. Report consignment sales under the retail sales tax classification. Companies that don't reach the maximum allowed emissions are free to sell excess credits.

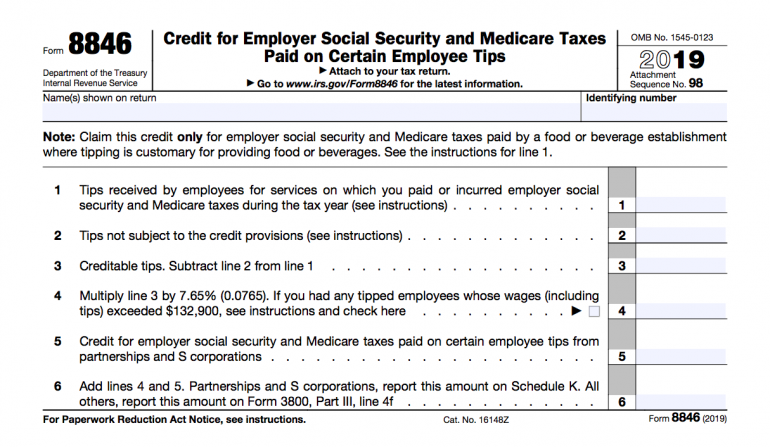

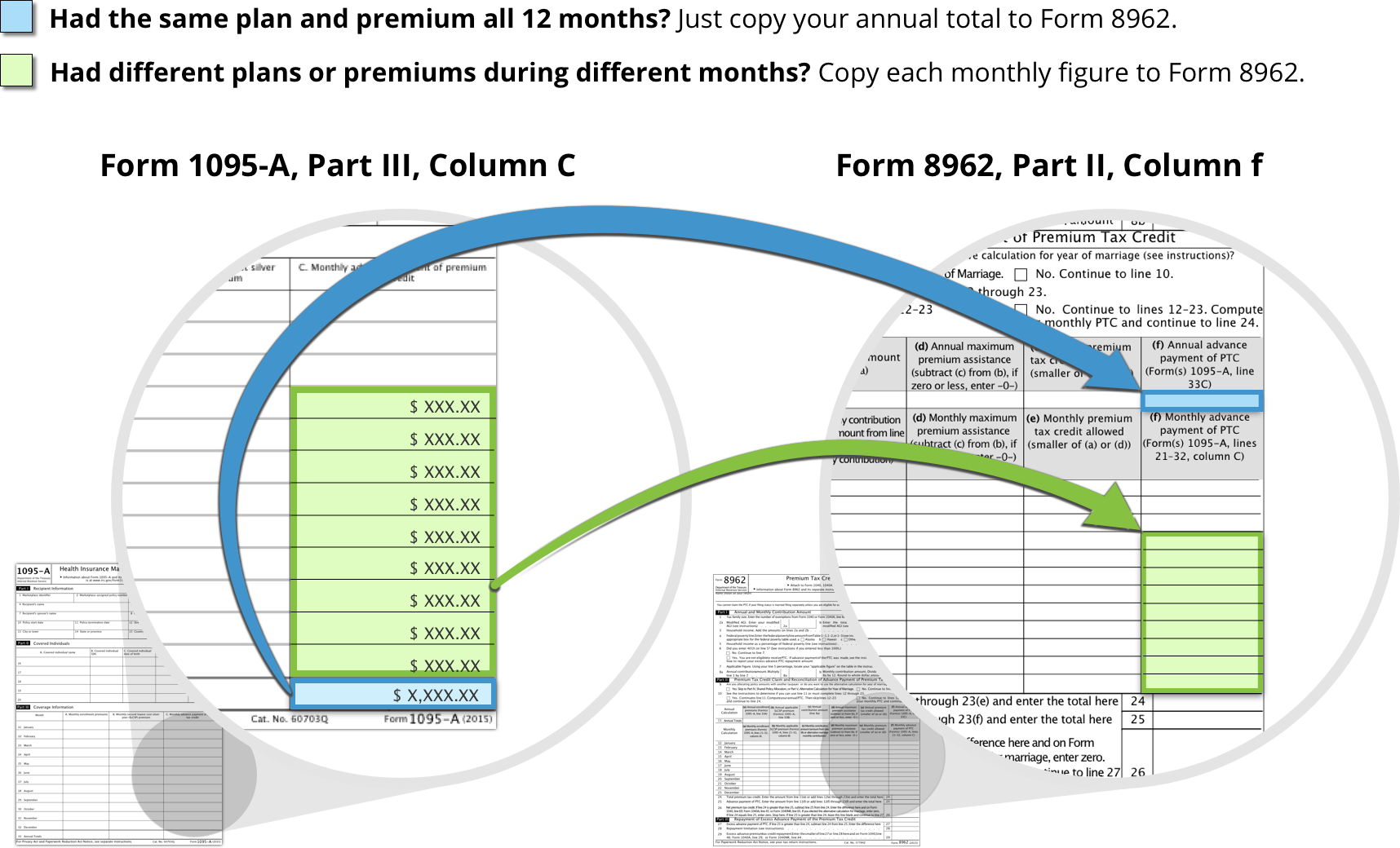

A developer or property owner interested in monetizing sc tax credits with the assistance of tcm will undergo a thorough vetting process and confirmation. The form you use to figure each credit is shown below. Tax credit forms you may also need.

Federal tax changes need help? For example, if the purchaser pays $80 for a credit that has a “face value” of $100 in year 1 and uses half of the credit to satisfy its $50 state tax liability in year 2, the purchaser would allocate. Faq for general business credits.

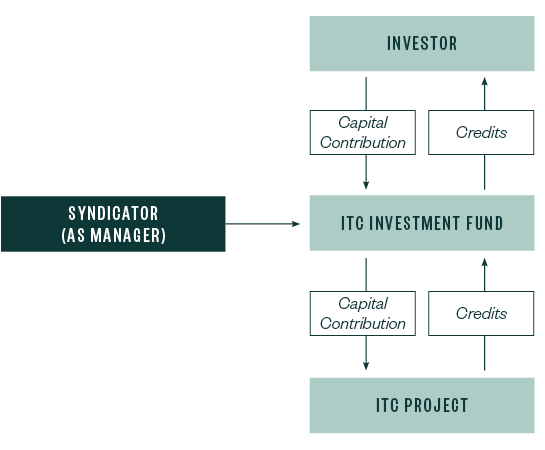

Limited partnerships or a syndication structure can be used to transfer the credit; How to apply for r&d. The credit selling program is only allotted $75m annually;

In general, these transactions are conducted through brokerage houses called. Overview allows companies holding qualifying research and development tax credits to apply for approval to sell those tax credits and assign them to the buyer (s). This video is about tax credit monetization as stripped securities, a type of deri.

Many people in washington are eligible to receive the earned income tax credit (eitc) from the irs when they file their federal income taxes. Second, apply for your tax. The state taxing authority can issue a tax credit certificate which can be sold to a third.

How to securitize and monetize your tax credits via a registered offering. First, register with conservation tax credit transfer by completing and returning our seller registration form.

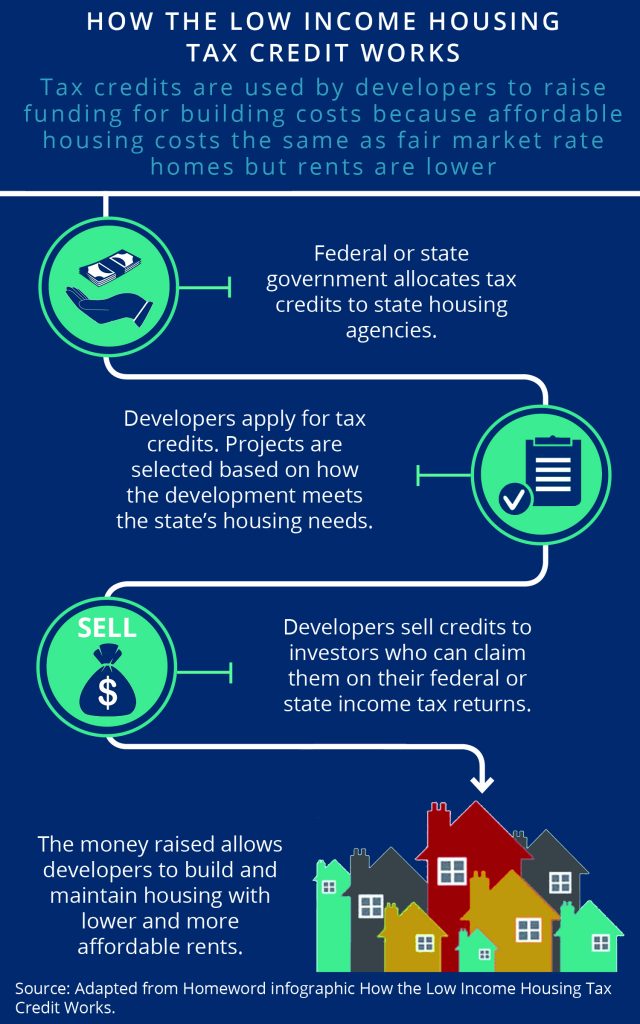

![Infographic] The Low Income Housing Tax Credit Program: How Does It Work? | Wilson Center](https://www.wilsoncenter.org/sites/default/files/styles/og_image/public/media/images/article/lihtc-mechanism-chart.png)

![Infographic] The Low Income Housing Tax Credit Program: How Does It Work? | Wilson Center](https://www.wilsoncenter.org/sites/default/files/styles/embed_text_block/public/media/images/article/lihtc-mechanism-chart.png)