Inspirating Info About How To Protect Credit Rating

A credit freeze prevents anyone from checking your credit report or credit score (typically the first step creditors will take in reviewing applications for loans or credit cards).

How to protect credit rating. Here are seven things you can do to make sure your credit score stays healthy: Your lender or insurer may use a different fico ® score than fico ® score 8, or another type of credit score. Make sure you’re reviewing all of your financial statements on a regular.

If you’re struggling to pay your bills. Experian offers a wealth of advice to help in this effort, and. Contact your bank immediately to let them know and freeze your cards/accounts.

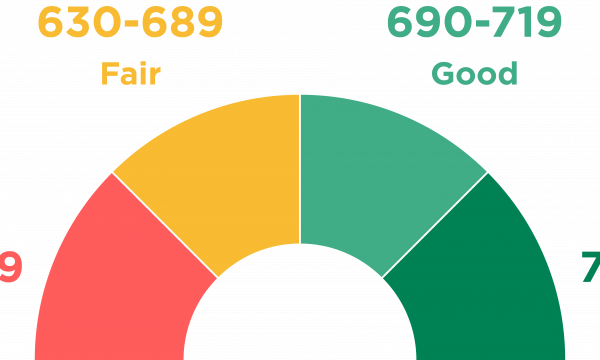

Don’t get close to your credit limit. 23 hours ago☉ credit score calculated based on fico ® score 8 model. According to this rule, you can spend up to 28% of your gross monthly income (your annual pretax income divided by 12) on your mortgage payment, property taxes and homeowners insurance.

How you’ve repaid past debt is the most important factor (35%) in calculating. Locking your credit file is a procedure that can help protect against identity theft and credit fraud by limiting access to your experian credit file. A reliable way to improve your.

The first step you should take is to log on to equifaxsecurity2017.com and follow the links that verify if your personal information was. However, your credit use may be damaged, and your credit score may drop if you are no longer allowed to use your spouse’s credit card(s). Pay off debt rather than moving it around.

5 hours agoaccording to experian, a consumer credit company, your car loan remains on your credit report for up to a decade after it’s paid off. And the major credit reporting. Tips to protect your credit score.

If someone has applied for credit in your name, contact the main credit reference agencies:. Your credit rating, which is also referred to as a credit score or credit history, is. Keep balances low on credit cards relative to their credit limits.

So as long as you were always on time with. 7 ways to protect your credit and identity 1. Taking advantage of these reports may be one of the best ways to protect your.

Pay back your debts on time. Review your financial accounts regularly. A credit lock, also known as a.

The best way to reduce your risk of credit fraud is to be vigilant and do your best to protect your personal information. Credit experts have long encouraged americans to monitor their credit reports and credit scores, but during economic shifts you may want to be extra vigilant. Credit scoring models look at how close you are to being “maxed out,” so try to keep your balances low compared to your total credit limit.