Exemplary Tips About How To Fight Irs Penalties

Ad trusted a+ bbb member.

How to fight irs penalties. Ad don't face the irs alone. Taxpayers in disputes with the irs are probably inclined to just surrender. Use the letter to compose a written request for penalty abatement based on.

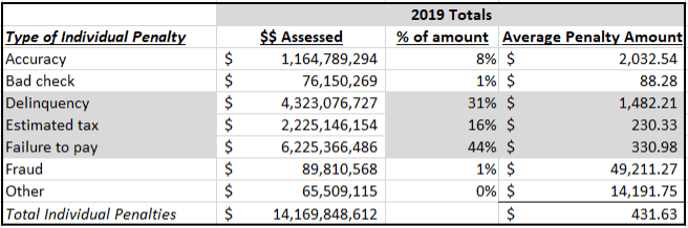

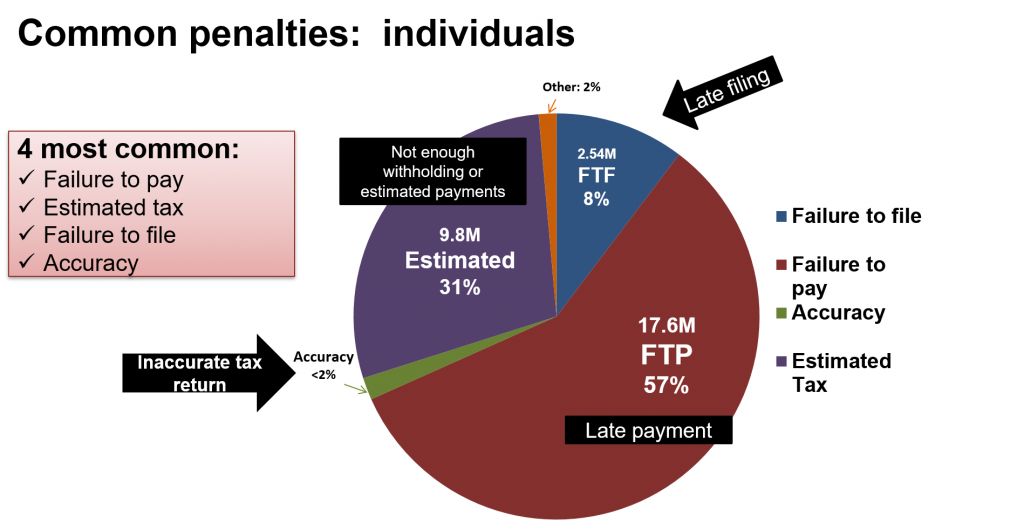

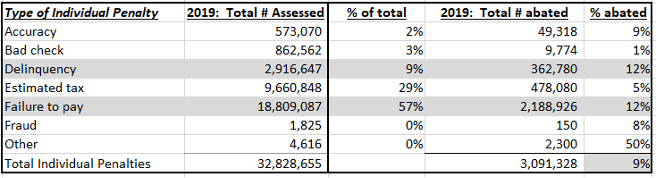

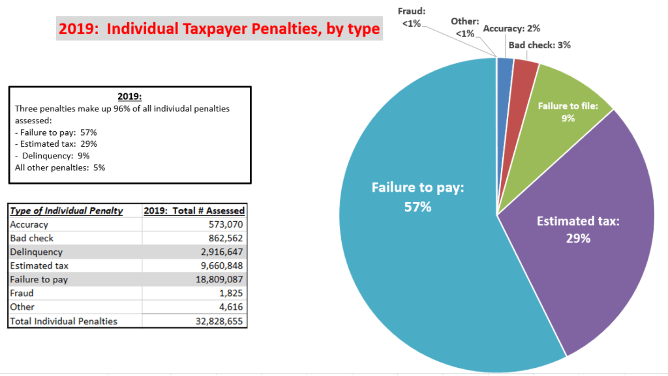

2 of the most common penalties are the failure to pay ( ftp) penalty & the failure to file ( ftf) penalty. Resolve your tax issues permanently. No fee unless we can help!

Ad bbb accredited & 'a+' rating. You can go to the united states tax. You may be given one of the following types of penalty relief depending on the penalty:

Immediate & permanent tax relief. Free case review, begin online. Find out now for free!

Irc section 6751 (b) imposes procedural requirements that the irs must follow before determining and assessing certain penalties. These requirements must be satisfied. Protest accepted if the protest is accepted,.

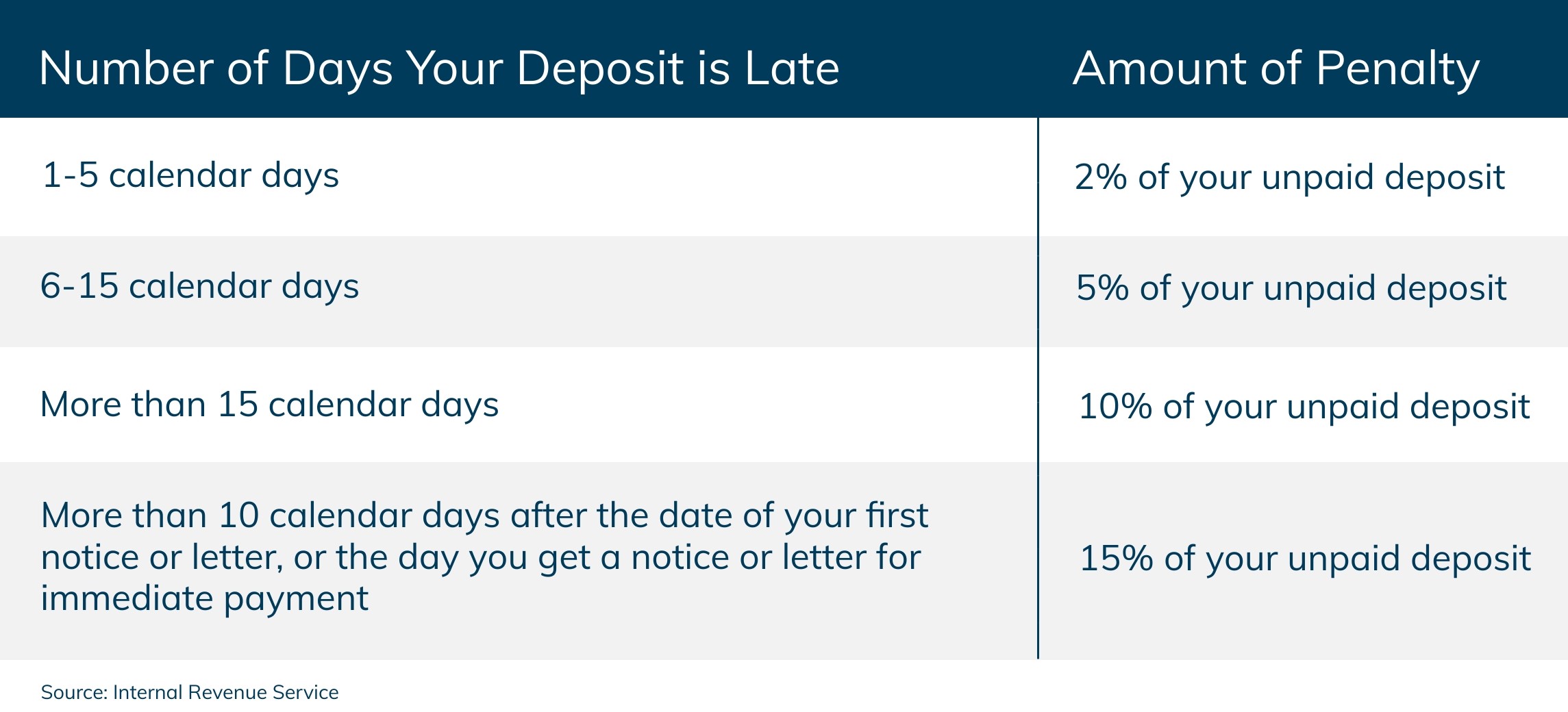

You can avoid a penalty by filing and paying your tax by the due date. Settle taxes owed and stop or prevent collections. Irs penalty abatement request letter(www.aicpa.org, aicpa tax section member login required):

Talk with our experts today. The internal revenue manual states that the irs. 4 what is willful neglect?

We provide immediate irs help to stop wage garnishment and end your tax problems. Irc section 6751 (b) imposes procedural requirements that the irs must follow before determining and assessing certain penalties. Federal tax advice contained in this website is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the.

Based on circumstances you may already qualify for tax relief. These requirements must be satisfied. Have a team of experts on your side

Apply for an extension of. Don't wait until its too late First time penalty abate and administrative waiver;.