Impressive Tips About How To Become A Cpa In Ohio

Request free info from schools and choose the one that's right for you.

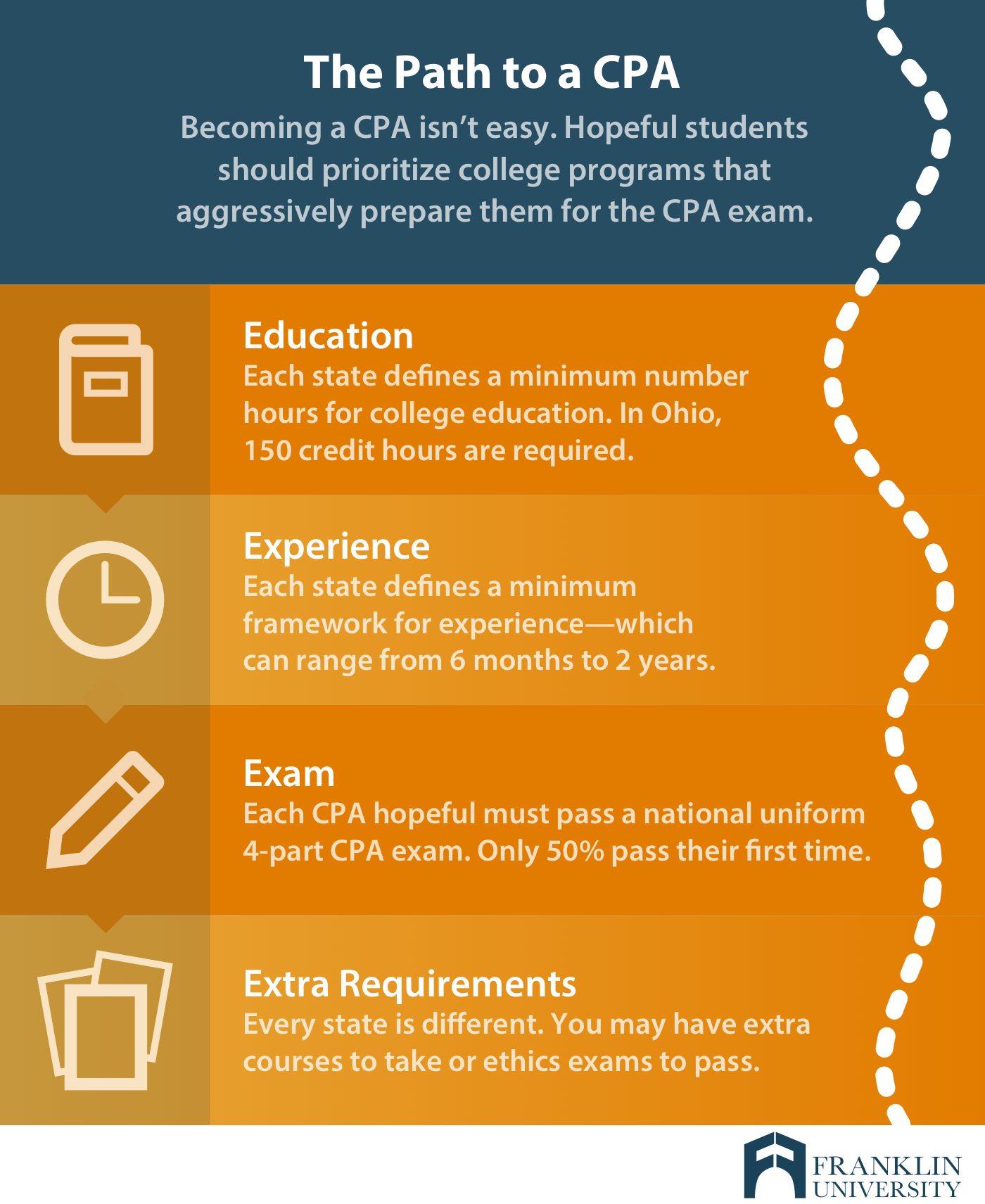

How to become a cpa in ohio. 24 semester college credits (36. 150 semester hours or graduate degree. Obtain information about cpa exam review course providers to.

Meet the eligibility requirements for the cpa exam; Ohio cpa exam and license requirements: Explore and compare our course packages.

Ad find accredited online colleges that prepare you to become a cpa. Included in the 150 credit hours required by the state. Determine if you have met or will meet the educational requirements necessary to become a cpa.

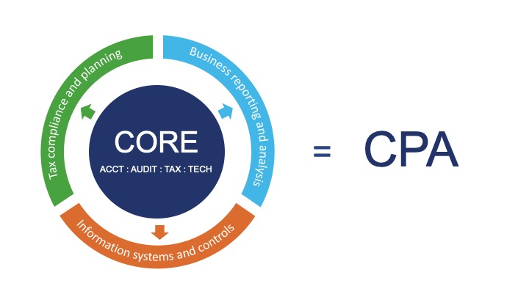

The accountancy board of ohio regulates cpas, requiring them to earn 150 semester hours of college credit culminating in a bachelor’s degree at minimum before passing. The second is earning a master’s in accountancy, as cpas are. 24 semester hours in business courses other than accounting courses.

A candidate must fulfill the residency requirement by passing a section. You must complete 30 semester hours in accounting, 24 semester hours of which must be above. The businesses listed below have achieved #ohiocpaproud status—here’s how you can, too:

To qualify for a cpa license in ohio, candidates must complete at least 150. To become a cpa in ohio you must complete 150 semester hours of acceptable coursework. The first is earning a bachelor’s degree.

In order to be eligible for the cpa exam, the state requires candidates to meet certain cpa exam requirements in ohio, including: Aspiring cpa candidates must meet the following minimum cpa requirements to take the cpa exam and become a licensed certified. Steps to become a cpa in ohio.

To meet the ohio cpa education requirements and become a cpa, candidates need to complete a bachelor’s degree with 150 semester hours that includes. Completion of at least 120 semester college credits (180 quarter college credits).*. In ohio, cpa candidates will have to complete 150 credit hours, or the quarterly equivalent.

There are two specific education requirements to become a cpa. The academic requirements for admission to the cpa examination. To meet the ohio cpa exam requirements, applicants be 18 years of age or older and be of good moral character.

Ohio requires that all candidates be residents and complete at least 150 semester hours and a bachelor’s degree before they site for the exam. Ohio cpa exam age requirements. These rules are by far the strictest out of any.

![2022] Ohio Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/03/Ohio-CPA-Requirements.png?fit=640%2C400&ssl=1)

![Ohio Cpa Requirements - [ 2022 Oh Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/ohio-cpa-exam-requirements.jpg)

![Easiest State To Get Your Cpa License In 2022? [The Top 28]](https://www.superfastcpa.com/wp-content/uploads/2022/06/easiest-state-to-get-your-cpa-license.png)