Outrageous Tips About How To Be A Cpa In Texas

Complete the electronic fingerprint process for a background check of the criminal history files of the texas.

How to be a cpa in texas. Texas cpa work experience requirements. Cpa exam requirements in texas. Resumes will be accepted only as supplements to an application.

Continuing professional education in texas. Texas cpas residing outside of the state and texas cpas that have a cpe. You must meet the following qualifications to take the cpa exam.

Successfully complete the uniform cpa examination. Compare our course technology to others. Here are essential steps to becoming a cpa in texas.

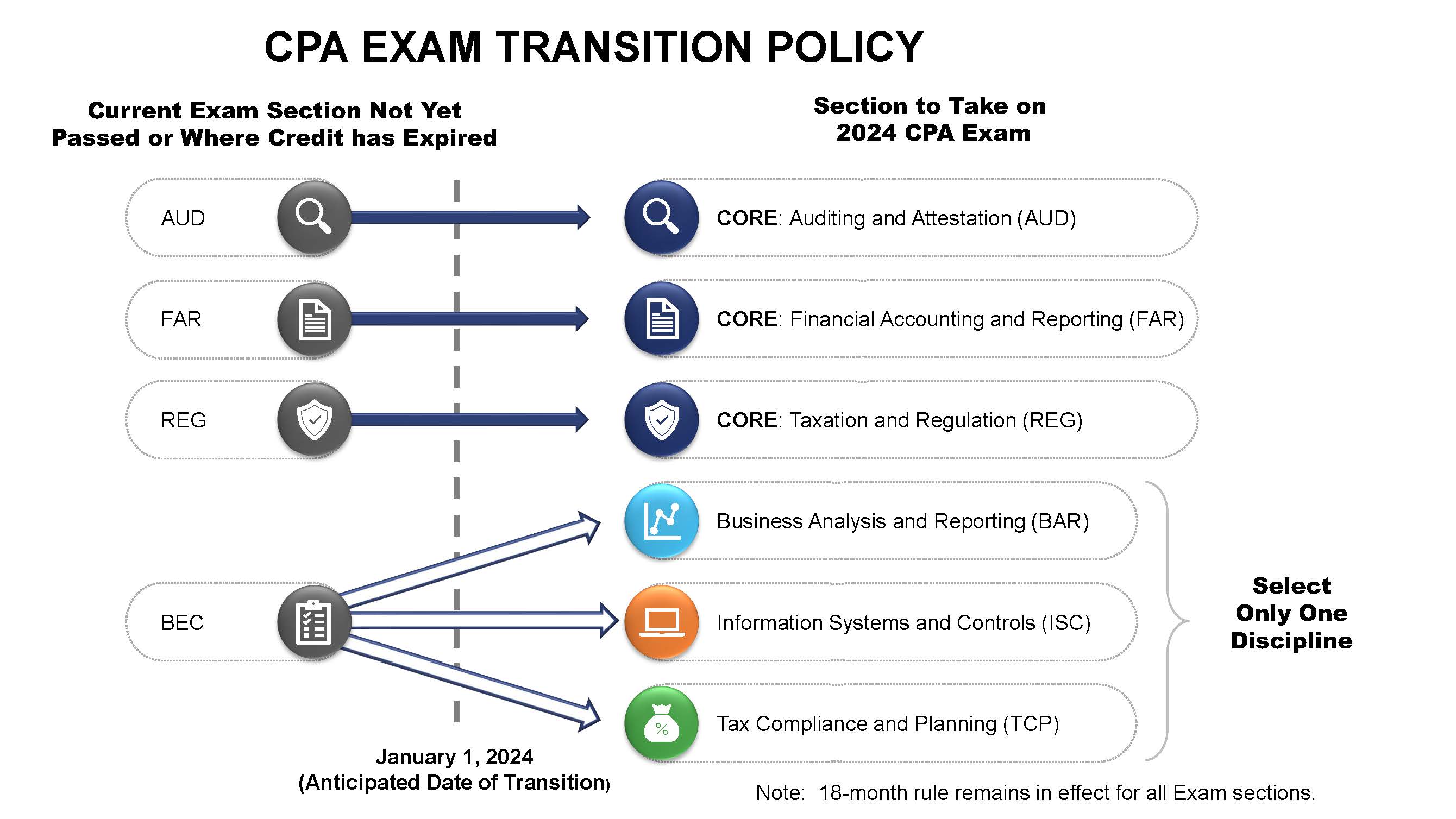

Roger's energy + uworld's revolutionary qbank will help you get to the finish line. Each state has its own set of eligibility requirements for the cpa exam, which should not be confused with licensing requirements. Apply for the uniform cpa examination.

If you have any further questions, please feel free to contact the enforcement division at: If you permanently move to texas, then you must obtain a personal license from the board if you. To be eligible for licensure, cpa candidates are required to earn at least 150 semester hours of college credit within a bachelor’s degree program or higher before passing.

As a cpa certificate holder in texas, you must complete continuing professional education (cpe) hours to maintain your cpa certificate. To meet the texas cpa education requirements to sit for the cpa exam, you’ll need a bachelor’s degree. To become a licensed certified public accountant in texas, the tx board of accountancy requires that you meet the following qualifications:

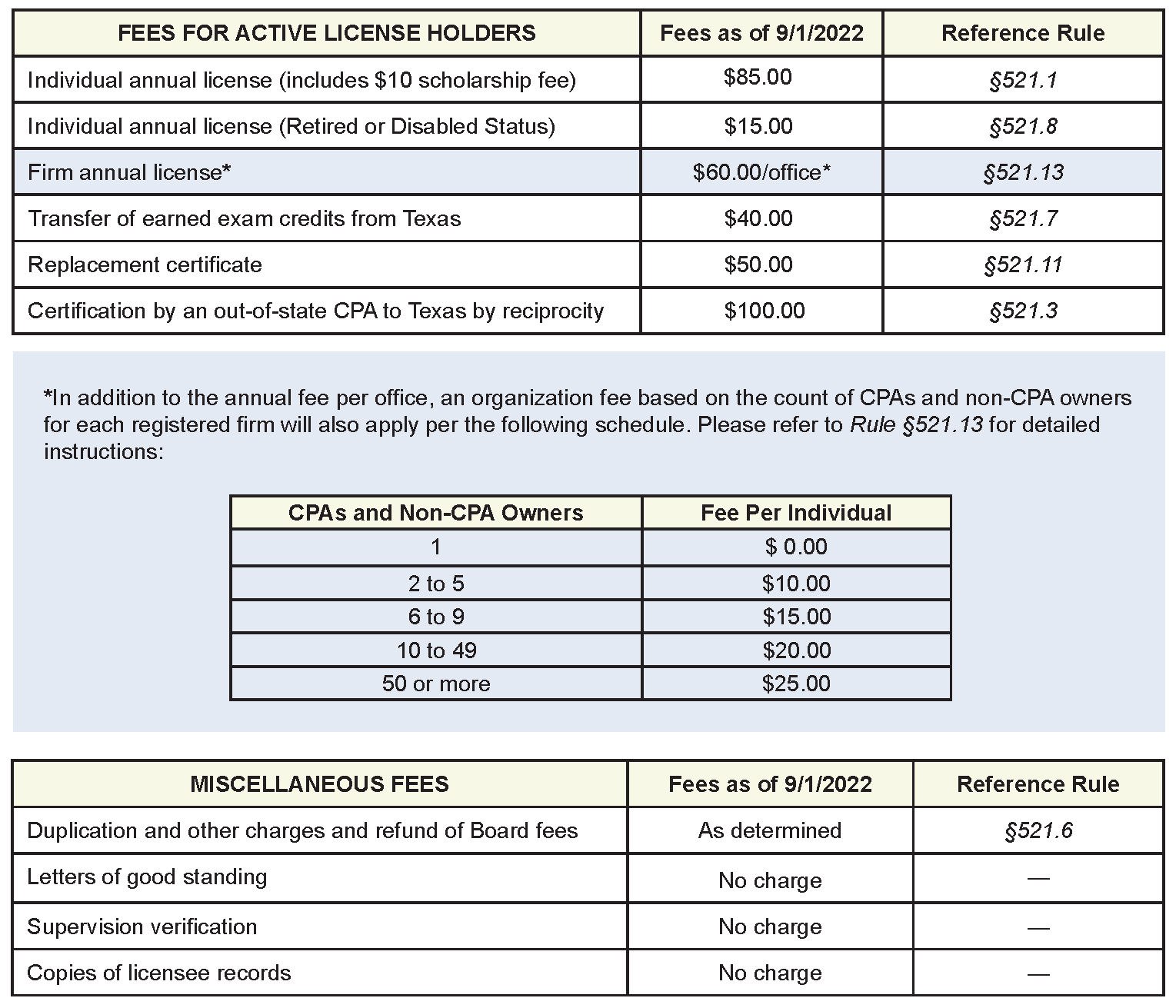

Ad see the surgent difference. Texas state board of public accountancy. Candidates must submit an application to the texas state board of public accountancy along with transcripts from an accredited school.

You will pay $20 and submit this form to start your process toward a cpa license. File an application for issuance of the cpa certificate. Ad get real cpa exam questions and comprehensive explanations.

Acquiring your cpa certificate in texas involves meeting specific requirements such as educational attainment, passing national and state exams, and work experience. Please contact a human resources representative if you need assistance or require accommodation during the. Compare our course technology to others.

Below we will be discussing the requirements for the. Complete a bachelor’s degree with at 150 credit. To comply with chapter 552, texas government code, known as the public information act, specific information about texas licensees, candidates for licensure, and cpa exam applicants.

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Examination-Process.jpg)

![Texas Cpa Requirements - [ 2022 Tx Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/texas-cpa-exam-requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Education-Requirement.jpg)

![Texas Cpa Exam & License Requirements [2022] - Cpa Clarity](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-texas.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Exam-License-Requirements.jpg)