Underrated Ideas Of Info About How To Apply For Vat Number In India

The answer to how to get tin number in india is very simple.

How to apply for vat number in india. The vat number in italy is called “il numero di registrazione iva”, short “p. Sole proprietors in possession of a valid maltese identity. Fill out the tin number application form and follow the procedures on the company's website to get a tin number.

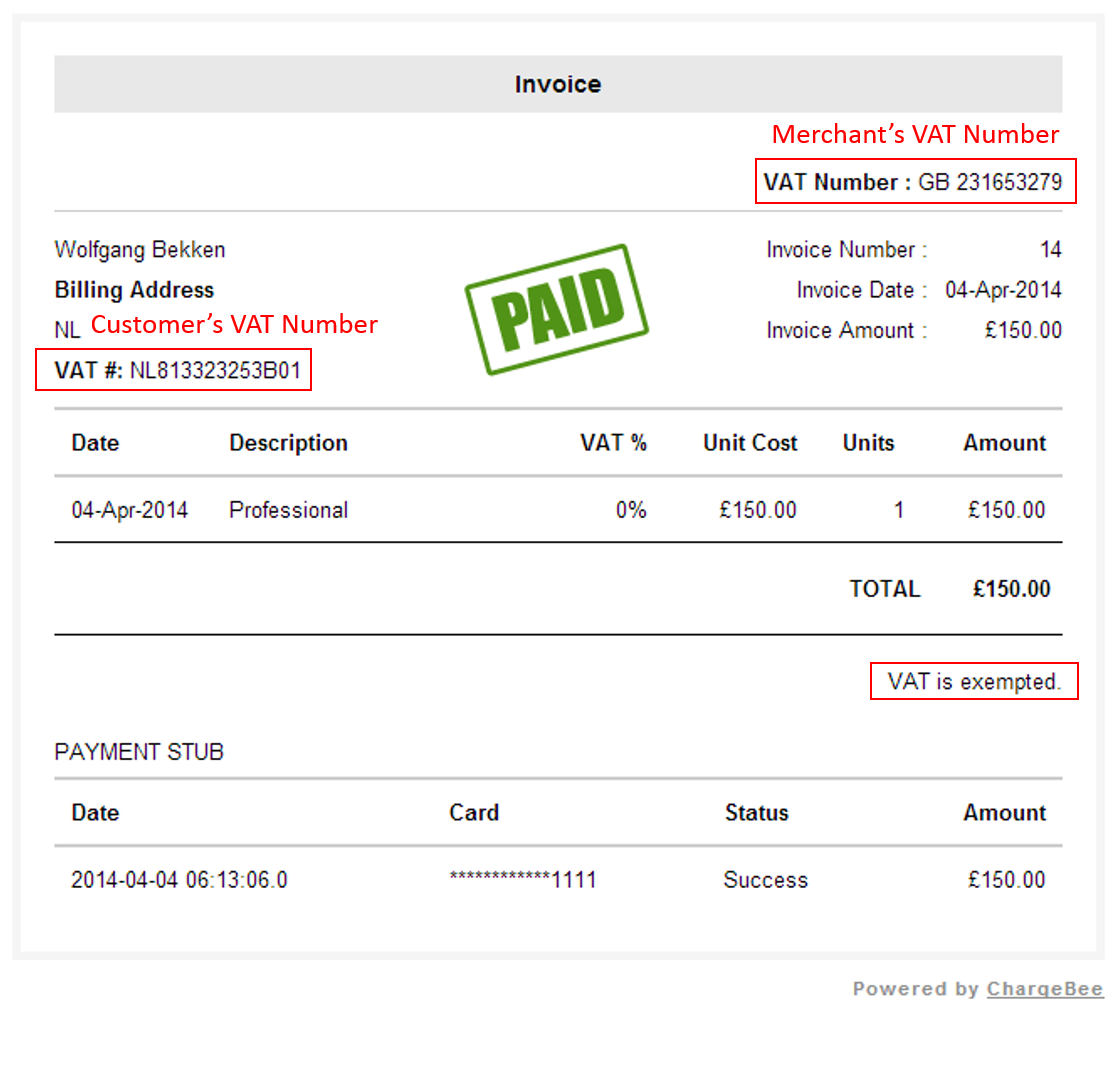

All information about vat registration in india. There are two ways to obtain a vat number: In the past, when there was no online possibility to apply for a vat number, it was necessary to send the application form by post.

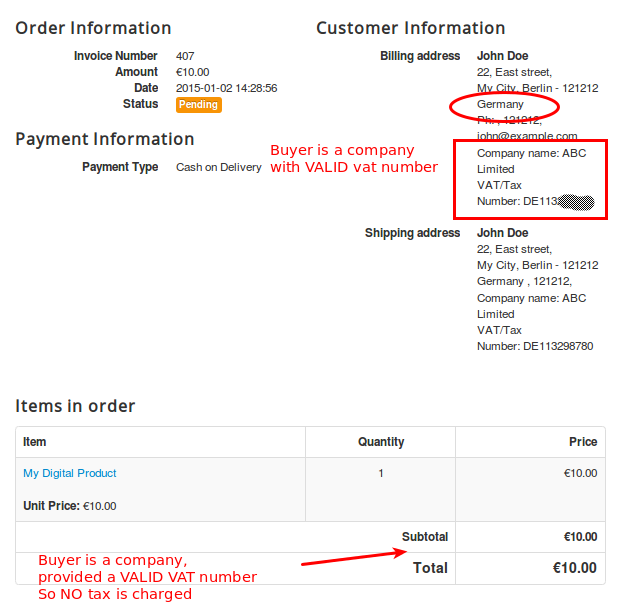

4% or 5% and 12.50%. Once the taxpayer submitted the application form, the. Determine whether you are registering as an individual, an agent, or an organization that is established in the state of application.

After the classic country code “it” it is. When the taxpayer submits the application form, a. There are two sets of rates that are applicable for most goods:

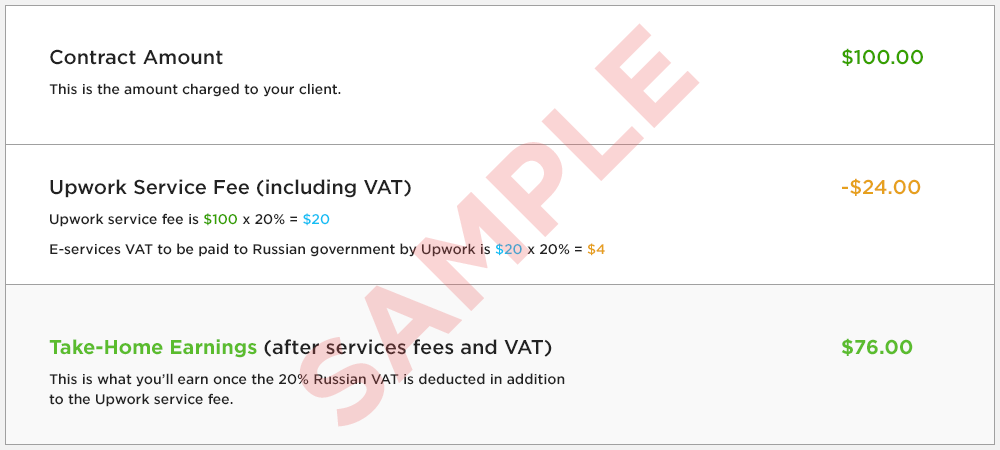

Your total vat taxable turnover for the last 12 months was over £85,000 (the vat threshold) you expect your turnover to go over £85,000 in. To account for the vat you’ll need to pay, tell your customer that you’ll be adding 20% to the original contract amount of £100,000 and then raise an invoice for £120,000. Steps to apply for a vat account online.

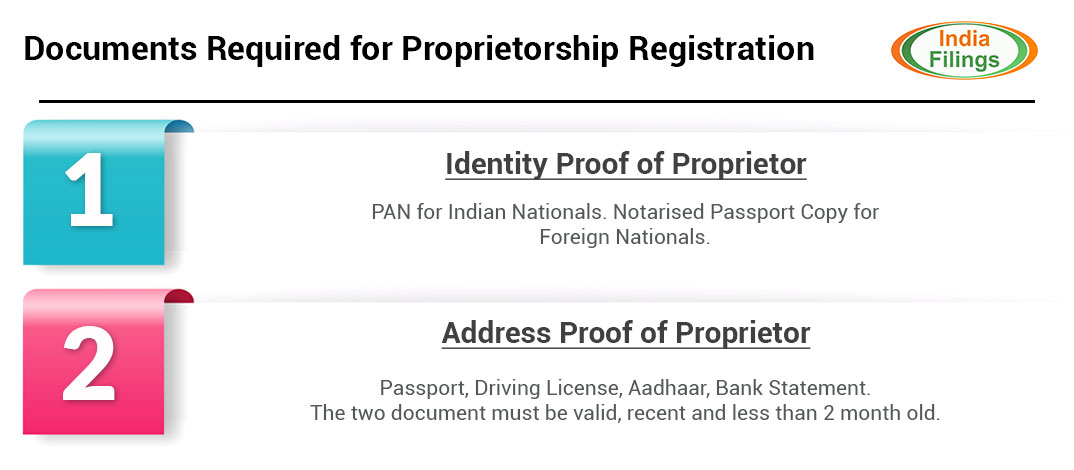

✓ registration limit & fees ✓ check registration status ✓ benefits ✓ procedure ✓ documentation. The process is very simple for the applicants. What is the name and format of the italian vat number?

The registration can be done both online and offline. When to register for vat. Apply for a vat number in paper form.

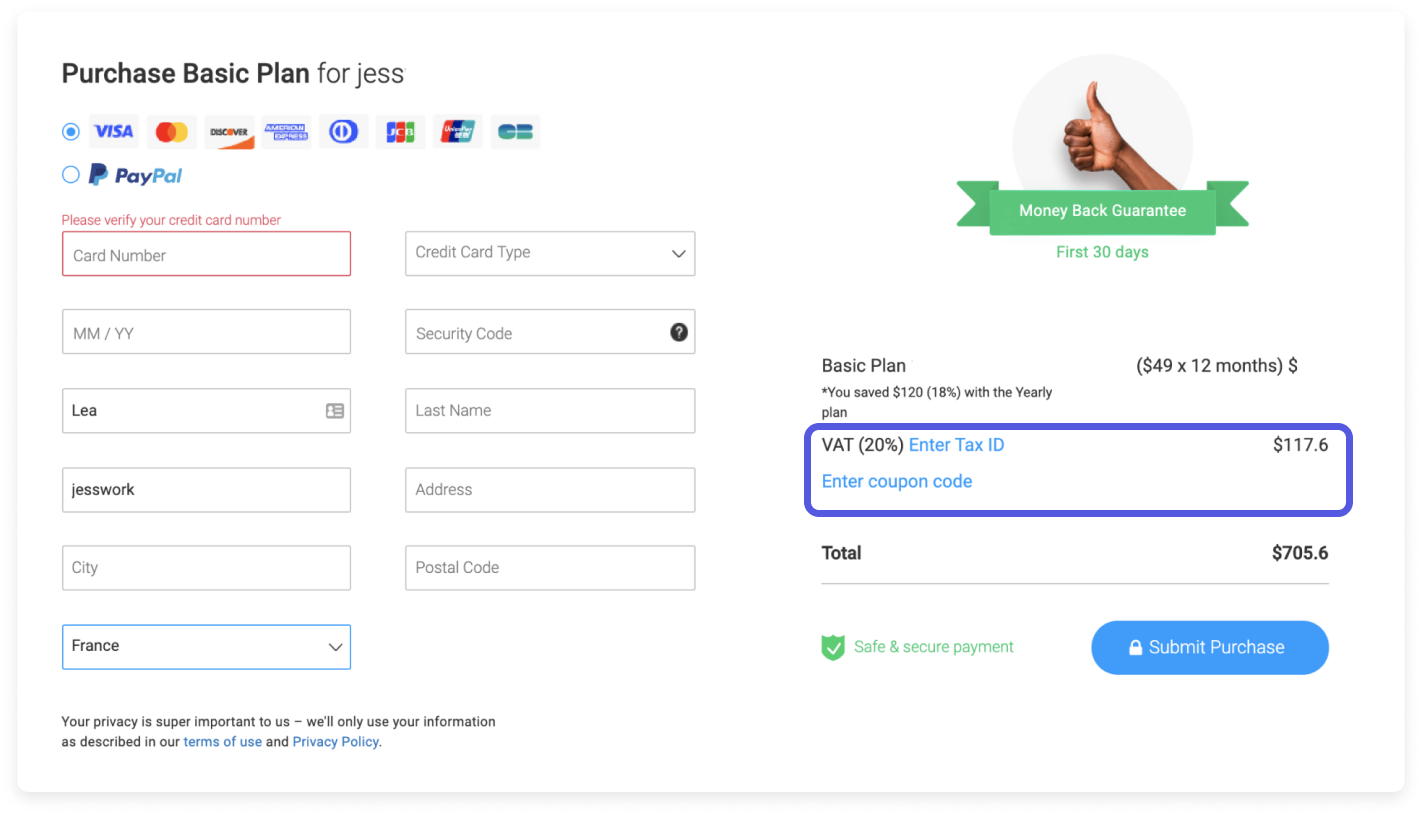

New applicants may register for a vat number by completing the proper application from the following list.